Jeevan Labh Policy Plan No. 936 might be consider the best plan for Insurance Cover along with High Returns.

Best quality of this plan is when we compare this plan with other LIC Policies, Jeevan Labh provides much higher Bonus percentage compared to rest of LIC plans.

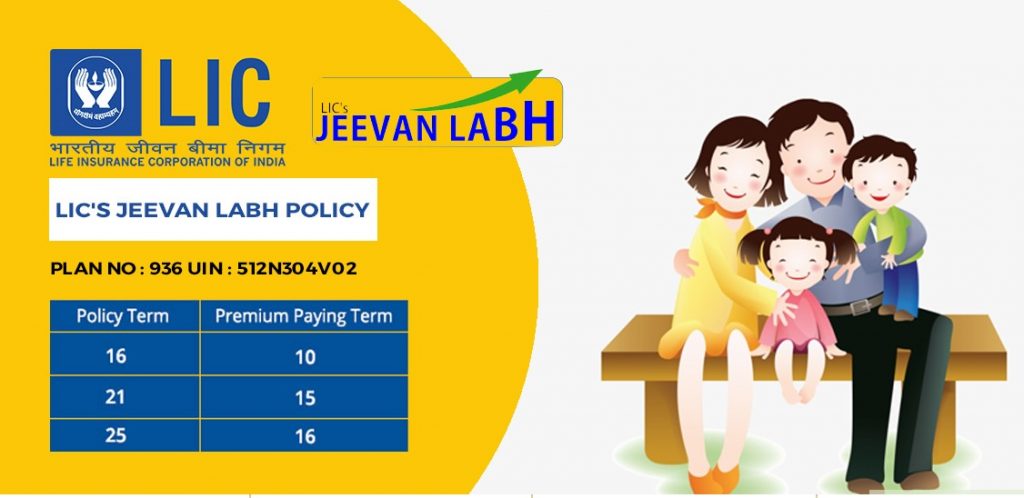

Other thing to note is that the Premium Payment duration is very limited in this policy. For Eg. If you are buying the Policy Term for 16 Years, then you only have to pay the Premium for just 10 Years. Likewise for 21 years Terms, you have o pay Premium for just 15 years & for 25 years terms the Premium payment duration is just 16 years.

Age Limit:

Minimum Age to buy this Jeevan Labh Plan is 8 Years. Meaning the person on whose name we are buying this Policy should be at least 8 years old. Maximum age to buy is 59 years. Any Person above the age of 59 years can’t buy this policy.

Mode of Payments:

We can pay the Premium on Yearly, Half-yearly, Quarterly & even on Monthly basis. So we have full power to decide as per our requirement.

Payment are accepted as Cash through your Agent, Cheque & Online payment is also available.

Sum Assured:

Sum Assured means for how much amount you want to buy this policy. Minimum Sum assured is 2 lakh INR, so if you pay the premium of ₹2 lakh then your returns will be counted on that basis. There is no Limit to Maximum Sum Assured for this policy, LIC will deicde the maximum premium for you depending on your Income and financial facility.

Let’s take an Example

| Current Age – 30 Yrs | Policy Duration – 21 Yrs | Premium Paying Term – 15 Yrs | Sum Assured – 10 Lakh |

|---|---|---|---|

| Maturity at Age – 51 Yrs | Pay for 15 Yrs | No Payment for – 6 Years | Approx Return – 20 Lakh 87 Thousand |

Here when a person of Age 30 bought Jeevan Labh policy for 10 Lakh, he will have to pay around ₹54,800 including taxes for the next 15 years. In this 15 years out of the sum assured of 10 Lakh, he only has to pay around 8 Lakh 23 Thousands INR, the rest will be covered by LIC. After that he doesn’t have to pay any Premium for the next 6 years.

When the policy duration completes at now his age of 51 years, he will get Approximately 20 lakh 87 thousands on his investment of 10 lakh INR.

Additional Benifits:

- The policy also cover Accidental Death benefits as well as disability benefits.

2. We can also take loan on this policy if required.

3. Tax benefits are also applicable in this policy.

Disclaimer:

I am not an expert on this matter. This is just my personal knowledge which I got from reading. Please do your own research properly and then only decide what’s best for you. Hope my provided information helps.