Let’s take a look at the LIC Jeevan Lakshya Plan No. 933 which covers Child care future plan as well as Life coverage plan.

This LIC plan is a better option when you are planning for the future of your kids. Not just that, this Insurance policy also helps in future planning for oneself.

With High Risk Cover and a good Savings this plan also cover, this plan also has a facility of Maturity Payable after the death of Policyholder. And if the Policyholder survives then also Maturity is payable at the end of Policy term.

Sum Assured:-

The Minimum Sum for this Policy is ₹1 Lakh and maximum is as per your limit. The basic sum assured can be only in the multiple of ₹10,000

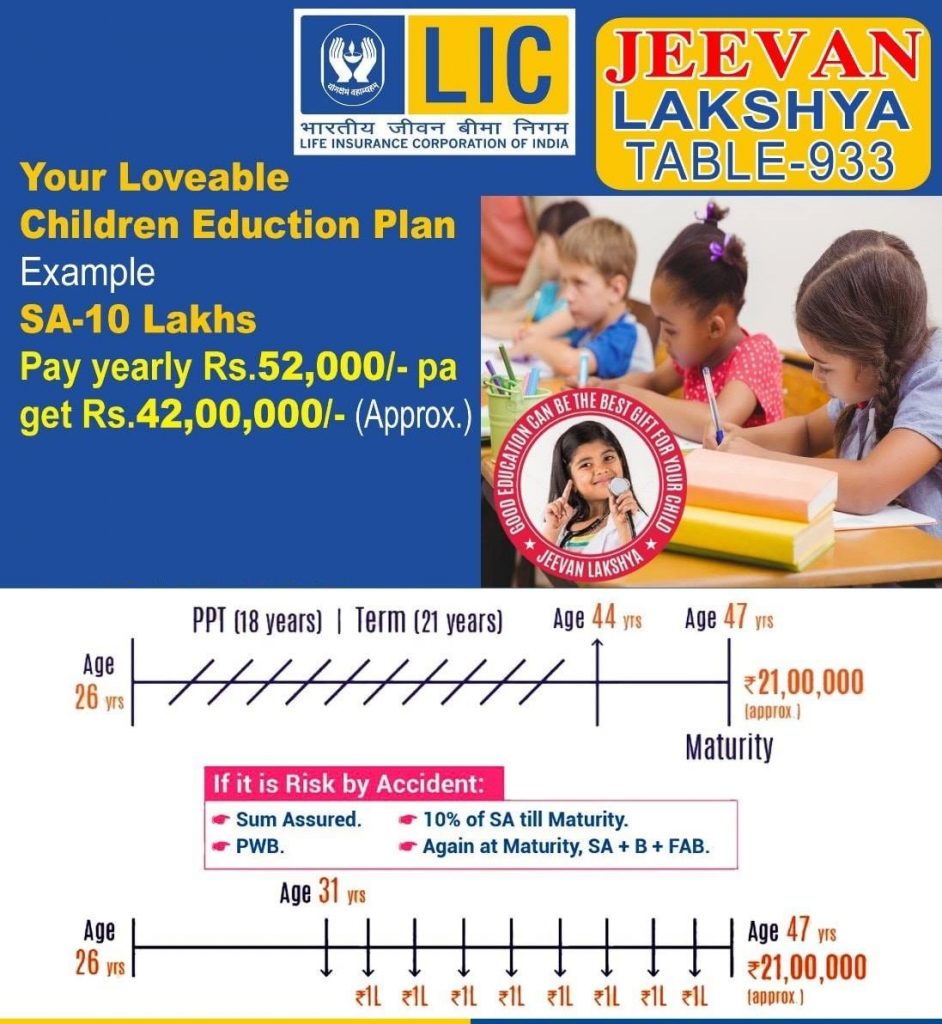

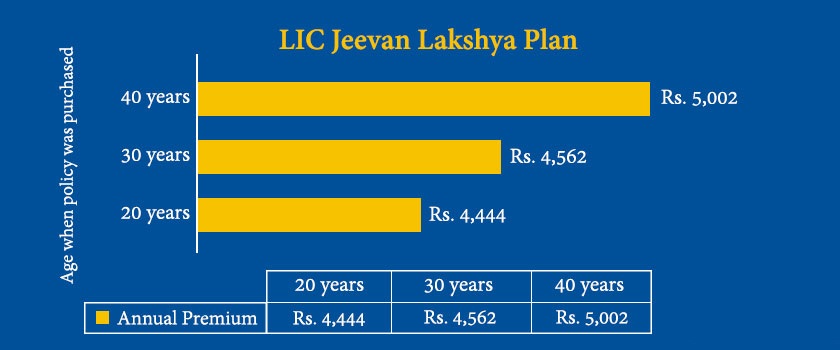

Premium is a little higher as the benefits of the Policy cover lots of aspects scenarios. Premium paying term is 3 years lesser than the Policy term. For example if you bought the policy for 20 years then you only have to pay the Premium for 17 Years (20 Years – 3 Years).

Let’s take an example:-

If you want to secure some money for your kids higher education then this plan will be a better selection for it.

When you buy this policy for your kid at his age of 1 Year, he will get the maturity amount at his then age of 22 years. During this policy period if the Policyholder dies then the family don’t have to pay any more of the remaining Premium amount, but still they will get the Maturity amount at his age of 22 Years.

Plus the make their daily ends meet the nominee will also get 10% of the sum assured annually. So if the Policy is worth ₹10 lakh then the nominee will get ₹1 lakh annually till the time of maturity period.

Policy Term:

The Policy term lies between 13 years to 25 years. Means we can’t purchse this policy for more than a period of 25 years.

Age Limit:-

The Minimum age to buy this policy is 18 years or older, and maximum age is 50 years old. So you can’t buy the policy on your kids name is he isn’t of the legal age as per the policy. You can buy this on your name and then attach your kid as the nominee.

Mode of Payments:-

Youcan pay the Premium on Yearly, Half-yearly, Quarterly & even on Monthly basis. So you have full power to decide as per your requirement.

Payments are accepted as Cash through your Agent, Cheque & Online payment is also available.

Additional Benifits:-

- The policy also cover Accidental Death benefits as well as disability benefits.